Your current location is:Fxscam News > Foreign News

Microsoft launches Mu small model, teams up with three chip giants to boost on

Fxscam News2025-07-22 22:05:02【Foreign News】3People have watched

IntroductionForeign exchange trading principles and practices, third edition,Cyprus foreign exchange dealer ranking,Microsoft Launches Mu Lightweight Language Model to Enhance PC AI Response ExperienceOn Monday, Micr

Microsoft Launches Mu Lightweight Language Model to Enhance PC AI Response Experience

On Monday,Foreign exchange trading principles and practices, third edition Microsoft announced the release of its latest lightweight language model, Mu, designed for localized operation on Windows systems to enhance AI interaction experiences on personal computers. The Mu model has been integrated into the intelligent agent module in Windows settings and is currently open for testing to Insider preview users in the Copilot+ program.

This model converts natural language input into system operation commands, allowing users to control system functions in a more intuitive manner, significantly simplifying operational processes.

NPU Accelerated Computing Enhances Real-Time Processing Performance

Microsoft highlighted that all computational tasks of the Mu model are carried out by a Neural Processing Unit (NPU) instead of traditional CPUs or GPUs, thereby unloading the main processor and enhancing energy efficiency. Testing data shows that its response speed can reach over 100 tokens per second, fulfilling the needs for system-level real-time interaction.

Mu is trained based on the NVIDIA A100 GPU and achieves algorithm optimization through the Azure Machine Learning platform, ensuring the model remains highly efficient while being lightweight.

Collaboration with Three Major Chipmakers to Promote AI Terminal Popularization

To achieve multi-architecture compatibility, Microsoft has engaged in deep cooperation with AMD, Intel, and Qualcomm, customizing quantization inference schemes for each of their NPU platforms. This not only enhances Mu model's adaptability across different PC devices but also lays the groundwork for broader AI deployment.

Through this software-hardware collaborative optimization, the Mu model can achieve stable low-latency, low-power operation on various terminal devices.

Positive Market Response with Slight Increase in Microsoft Stock Price

Stimulated by the new product release, Microsoft's stock price slightly increased on Monday, closing at $488.13 with a 0.44% rise. Investors are generally optimistic about Microsoft's positioning in the endpoint AI application field, seeing strong medium to long-term growth potential.

The launch of the Mu model is seen as a crucial step in advancing Microsoft's Copilot ecosystem, potentially unlocking further AI capabilities at the operating system level.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

Very good!(8136)

Related articles

- SK Markets: Scam Exposed

- Trump's tariff remarks boosted risk aversion, lifting yen and gold, pressuring risk assets.

- The European Central Bank is concerned about the instability in the inflation outlook.

- Japan denies Besant's statements regarding the yen exchange rate.

- Review of Trading Pro: Is Trading Pro a legitimate broker?

- The Night Before the Pound's Turmoil: Bailey Admits Weakness in the UK Labor Market

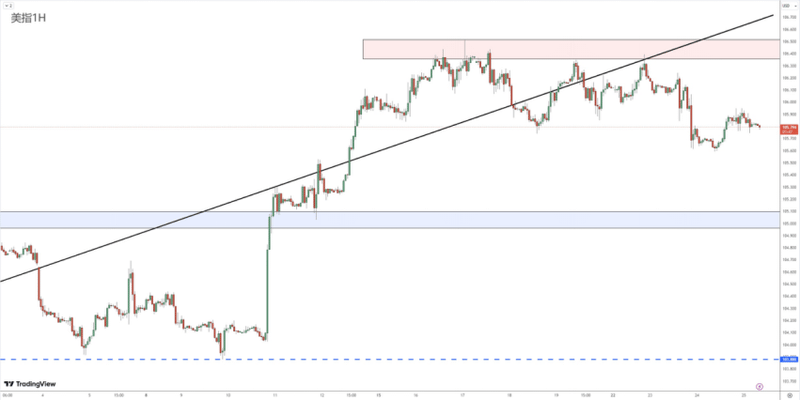

- The US Dollar Index fell below 97, marking its lowest point in over three years.

- Trump confirms tariff hike plan to proceed as scheduled.

- iVision Market Blocks Investor Accounts & Profits

- Eurozone jobless rate rises unexpectedly as US

Popular Articles

Webmaster recommended

Market Insights: Dec 5th, 2023

The Reserve Bank of Australia faces its first consecutive rate cuts in six years.

Escalation of Middle East conflict pushes gold and oil prices higher amid rising risk aversion.

Eurozone faces twin deficits as EU

Is NKVO compliant? Is it a scam?

Bostic warns tariffs may fuel persistent inflation; Fed likely to cut rates only once this year

The Euro faces its biggest opportunity window in 25 years.

Euro surge sparks short squeeze as Goldman and Morgan Stanley turn bearish on the dollar